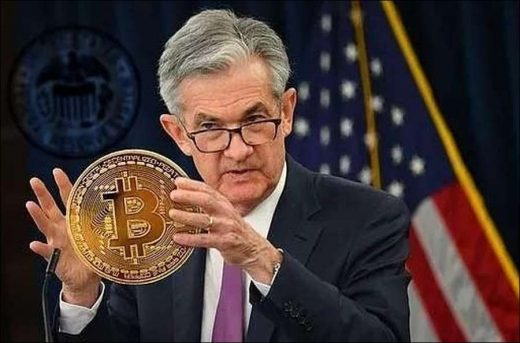

Fed interest rate decision. All markets in the world will focus on the interest rate decision of the Federal Reserve (Fed) and Powell’s speech on November 1, 2023. According to CME data, there is a 97.4% certainty that it will remain stable in the range of 5.25% to 5.50%.

Those expecting an interest rate increase are around 2.6%. In his speech in front of the New York Economic Club last week, Powell stated that tight financial conditions may be necessary, but the Fed’s actions may be less needed due to rising market interest rates. That’s why Powell’s speech at the FOMC press conference (Eastern Time – 2:30 pm ET) is of great importance.

The core personal consumption expenditures price index, which excludes food and energy items followed by the Fed last week, increased by 0.3% on a monthly basis and 3.7% on an annual basis, in line with market expectations. Looking at the data, although the downward trend continues, consumption must slow down at some point.

Joe Biden has requested from Congress $61.4 billion for the Ukraine war, $14.3 billion for aid to Israel, and more than $9 billion for responding to humanitarian crises, including Gaza, but the US budget deficit continues to increase .

In the cryptocurrency markets, the positive atmosphere created by the expectation of spot Bitcoin ETF approval continues. While Bitcoin dominance has reached the peak of the last one and a half years with 54 percent, it is preparing to close October with a green candle. On November 1, we will receive the earnings report of Microstrategy, which we know well with its Bitcoin investments. We are experiencing positive divergence in some altcoins such as Metaverse.

Visits: 54