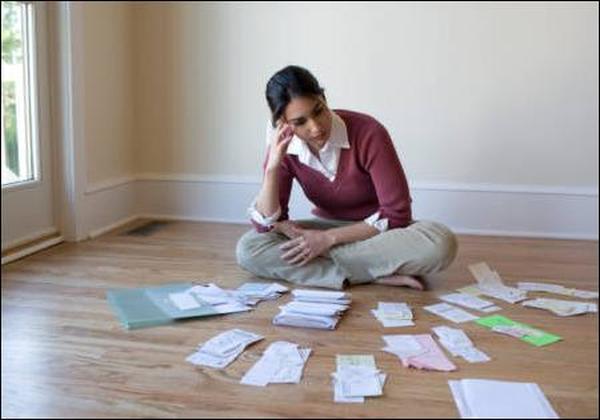

Disastrous myths about your credit score

Contrary to popular belief, paying bills on time is an overrated part of your financial reputation. People are obsessed with getting and keeping an excellent credit score. We hear these …

Disastrous myths about your credit score Read More