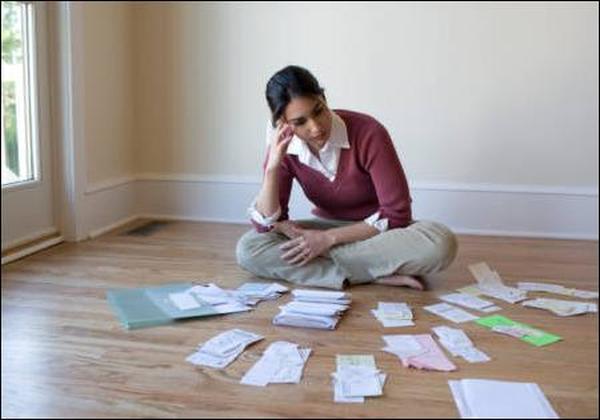

Spending cuts you might not even notice

These tricks could raise your income or reduce expenses without affecting your quality of life. It’s painfully clear Americans are still hurting financially. Jobless claims are far too high if …

Spending cuts you might not even notice Read More